Lessons I Learned From Tips About How To Buy Puts And Calls

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

Buy august 100 put for $3 (x100 = $300 total) cost:

How to buy puts and calls. Using our 50 xyz call options example, the premium might be $3 per contract. So, the total cost of buying one xyz 50 call. Nothing more to see here.

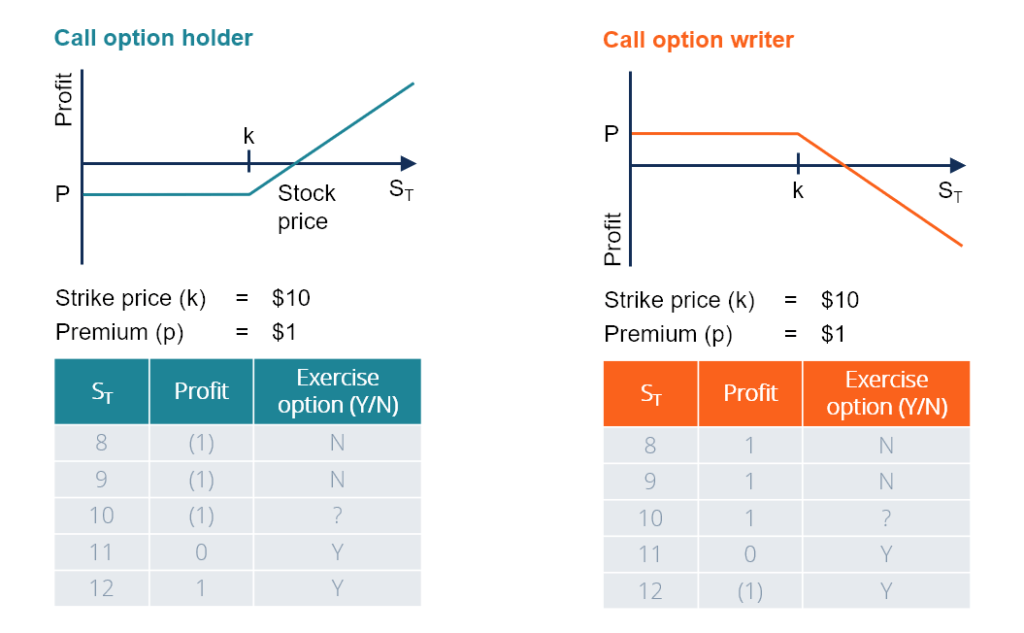

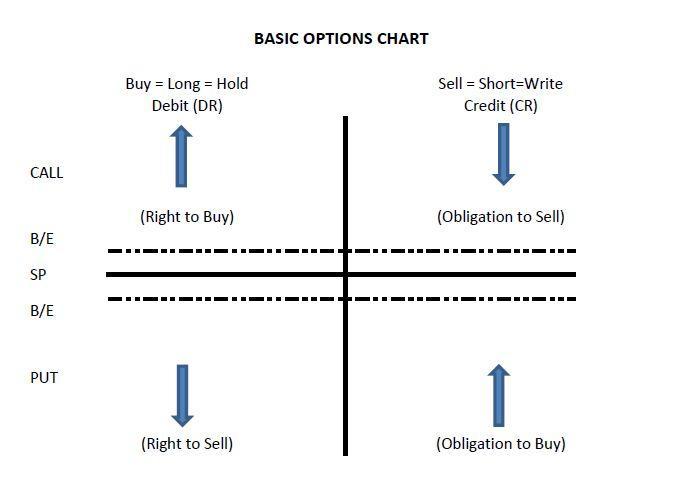

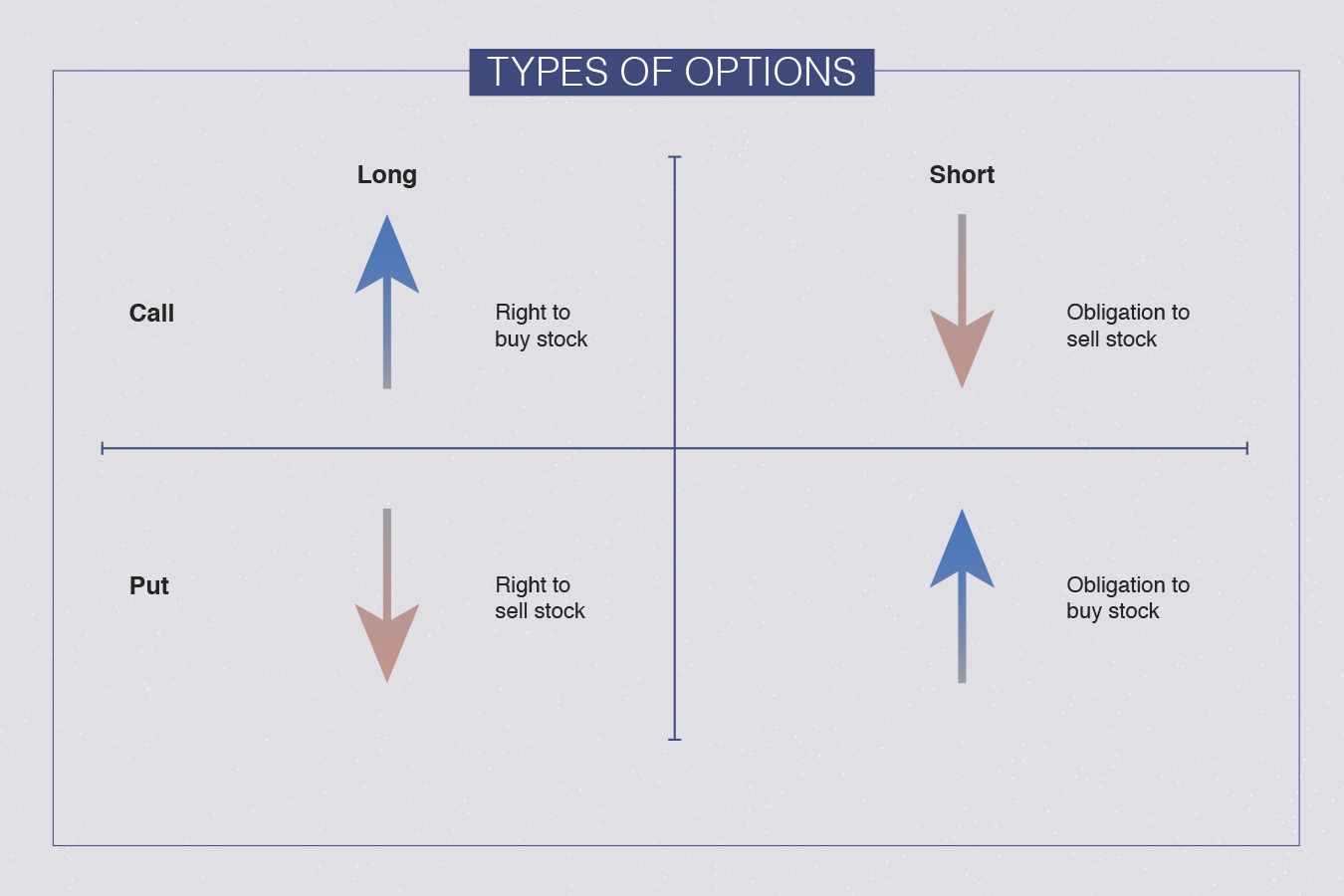

In times of uncertainty and volatility in the market, some investors turn to hedging using puts and calls versus stock to reduce risk. Calls are typically purchased when you expect that the price of the underlying stock may go up. When buying a call option, the buyer must pay a premium to the seller or writer.

Once an option has been. A call option, commonly referred to as a “call,” is a form of a derivatives contract that gives the call option buyer the right, but not the obligation, to buy a stock or other financial. Puts a put option gives the contract owner/holder (the buyer of the put option) the right to sell.

This is the price that it costs to buy options. Understand the main differences between two basic options strategies: But the investor doesn’t have to pay the market margin money before the purchase.

Theta is always a negative number for long calls and puts. When you buy a call, you have the right to purchase the underlying instrument at the strike price on or. Join tony zhang, chief strategist of optionsplay & cnbc contributor of options action as we introduce the pros and cons of buying calls and puts.

Buying puts (long puts) if a call option gives the holder the right to purchase the underlying at a set price before the contract expires, a put option gives the holder the right to. So, the total cost of buying one xyz 50 call option contract would be. Using our 50 xyz call options example, the premium might be $3 per contract.

Ad all the trading tools you need to quickly place your trades into the market. What you spent on the put (in this example, $3 x100; This is the price that it costs to buy options.

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)