Sensational Tips About How To Keep Track Of Mileage

Depending on the age of your vehicle, you either have a mechanical or digital odometer.

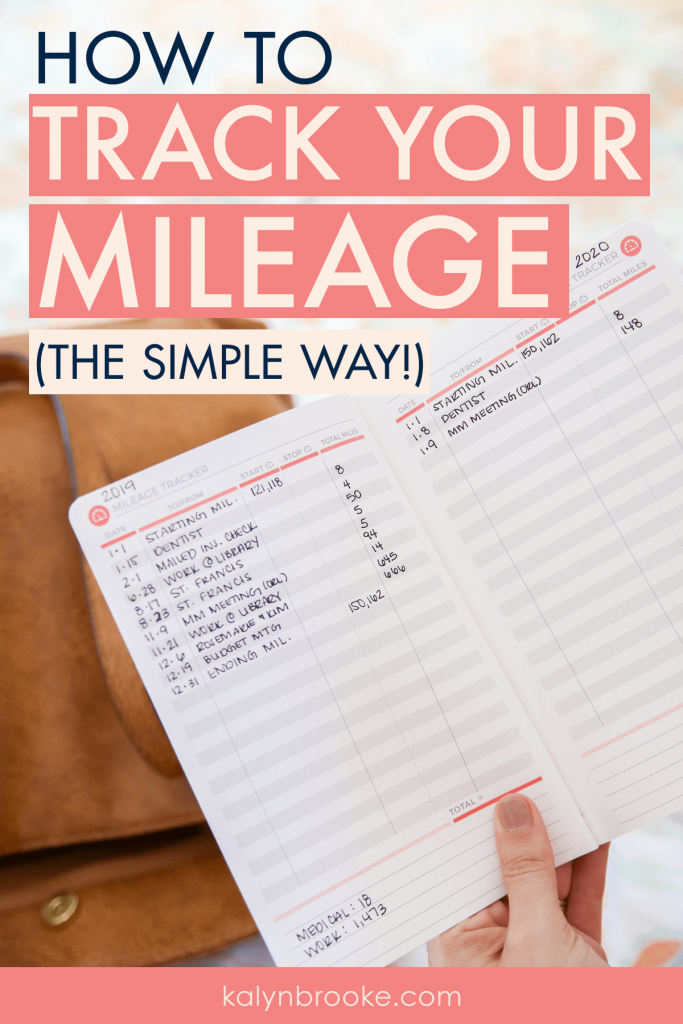

How to keep track of mileage. How to track your business vehicle’s miles as accurately as possible: Keep your log on paper and pay with your time (for beginners only!) keep your log with free or cheap software and pay the irs fine. The templates help you track the number of miles your vehicle has traveled in a.

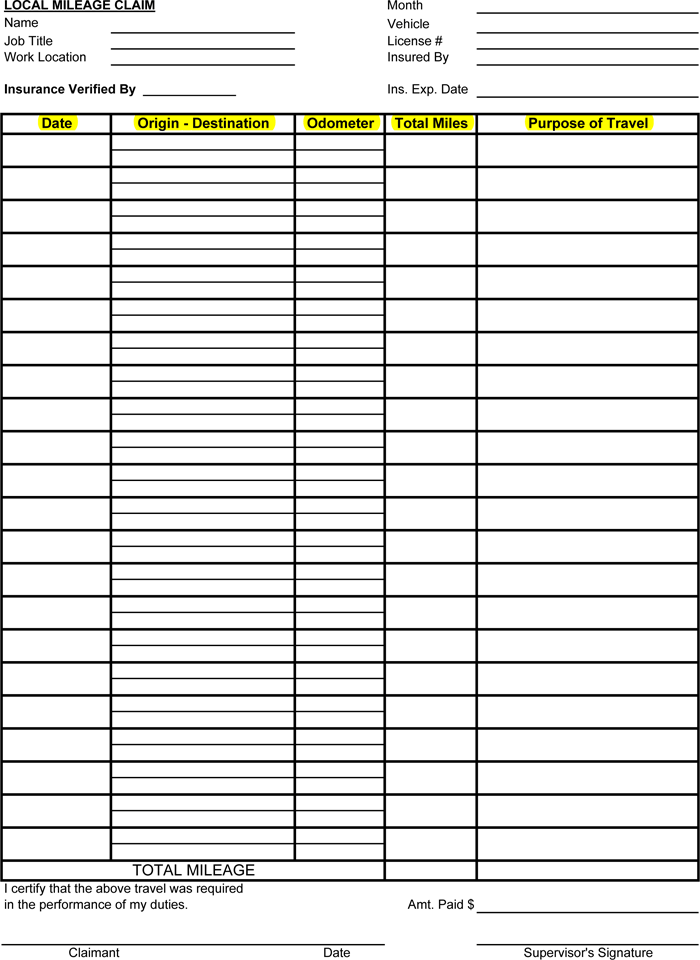

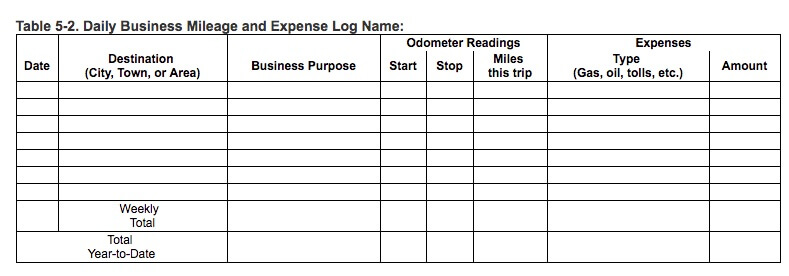

You will need four pieces of information for every business trip: Ad for less than $2 a day, save an average of 30 hours per month using quickbooks online. An odometer is an instrument attached to your.

We are one of few if not. Once you flag certain routes,. If you decide to go with the standard mileage rate as most americans do, you’ll need to keep a mileage log.

The irs requires you to document your mileage. 4 benefits of mileage tracking apps like mlog. The most apparent requirement of every fleet is to reduce operational costs.

If you decide to go with the standard mileage deduction over the actual expense method, all you have to do is track your qualifying miles and multiply it by the cents per mile. By employing mileage expense tracking, a company can get the following 7 benefits: Trip cubby is a fully featured, yet cleanly designed, application that allows users to keep track of miles put on their car.

Record business miles with your taxes in mind. Up to 40 trips per month full version: What’s the best way to keep track of mileage for taxes in 2022?

I know a lot of runners are ‘numbers people’ so this a great way to keep track of. Triplog is a mileage tracker app that helps managers make the expense reimbursement process much smoother. Let’s dive into the details!

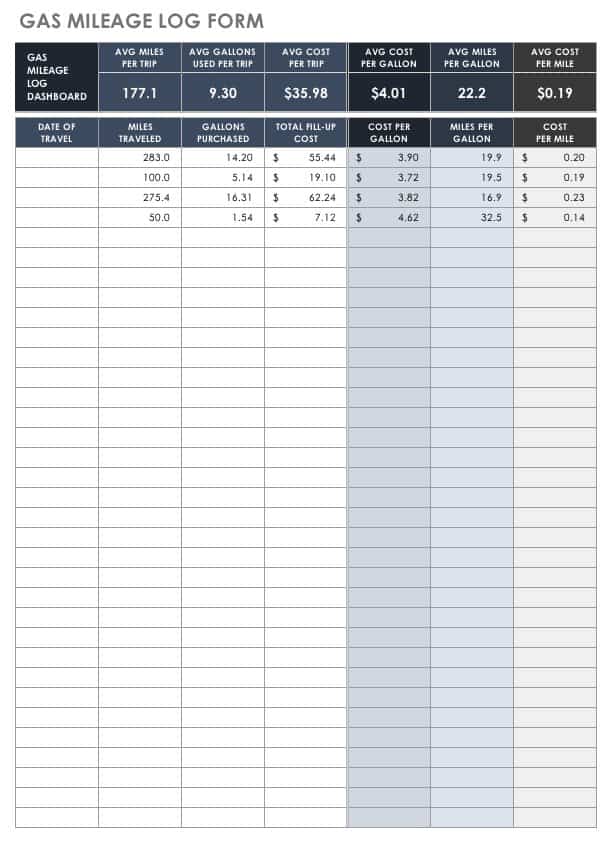

Yes, like og excel spreadsheet. Enter company and employee information at the top along with a time period, and then keep track of mileage and other expenses for each day of the week. “on the forecast track, the center.

The main this is, you have to actually log it. With the mileagewise app you can track your miles via vehicle movement tracking, a plug’n’go setup, or even bluetooth tracking. How do you keep your mileage record?

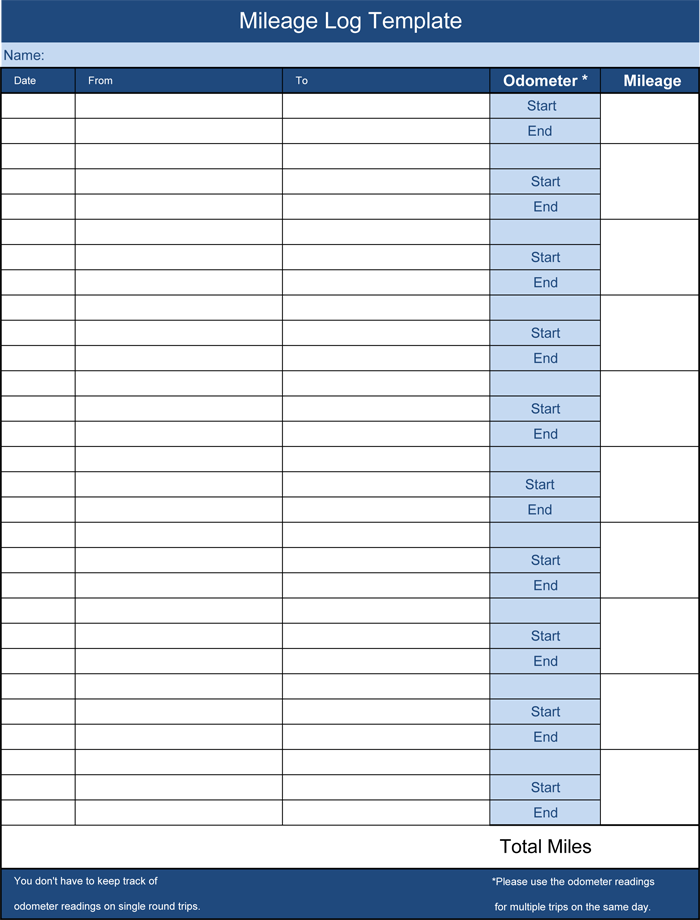

This app provides accurate, automatic mileage. The simplest way to track your mileage is with your car's odometer and a paper log book, marking down the odometer reading at the start. Download mileiq to start tracking your drives automatic, accurate.